Top 10 FinTech predictions for 2023 🔮

"If you don't think about the future, you cannot have one" - John Galsworthy

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 120k+ FinTech leaders:

As our world increasingly turns to digital, it’s important to look at the trends that will shape the future. If you want to see what's coming next in the financial technology industry, I invite you to explore my top 10 FinTech predictions for 2023. Coupled with 20+ bonus reads and extra resources, these are the only FinTech predictions you need for next year.

1. Venture Capital funding is going to be a lot different

Venture and growth investors in private companies scaled back their investment pace substantially following massive valuation collapses in the public markets. We can remember that in 2021, VCs poured a whopping $261.7B in FinTech across 2,923 deals. Yet, funding has dried out in 2022, and financial services innovators have only secured $81.4B in new capital across 1,798 deals, according to GlobalData.

What’s interesting is that this hasn’t been equally distributed. For instance, overall VC investment into European FinTechs has dropped only 24% from 2021's highs. This is still x2 times bigger than the numbers seen in 2020.

But looking ahead, despite record funds raised by VC firms in 2021 and 2022, I don’t think we will get back to 2021 numbers (on a global scale) anytime soon. VCs will probably continue being more risk-averse, and more selective hence increasing the funding time and pushing both the round sizes and valuations down.

Bonus:

The Big VC Pullback everyone was expecting is here and it's bad for startups 😔

What SoftBank’s collapse means for the future of FinTech investments 🥶

Triple your chances of getting funded with this cheat sheet 💸

Raise 20% more cash for your startup with this trick 🤑

2. B2B FinTechs will thrive

In the US alone, the business-to-business payments transaction value is around $28.6 trillion. This is several times bigger than the retail payments market and a gentle reminder of why Stripe was once valued at $95 billion (might actually be worth more in the next 5-10 years). Hence, while challenger banks, stock brokerages, or other consumer FinTechs might find it harder to attract and retain users, B2B payments, Buy Now, Pay Later, revenue/invoice financing and etc. startups should be doing pretty well. Additionally, they probably won’t have any issues attracting capital too. Someone that does this well - American Express AXP 0.00%↑.

Bonus:

AmEx enters the lucrative B2B payments space 💸

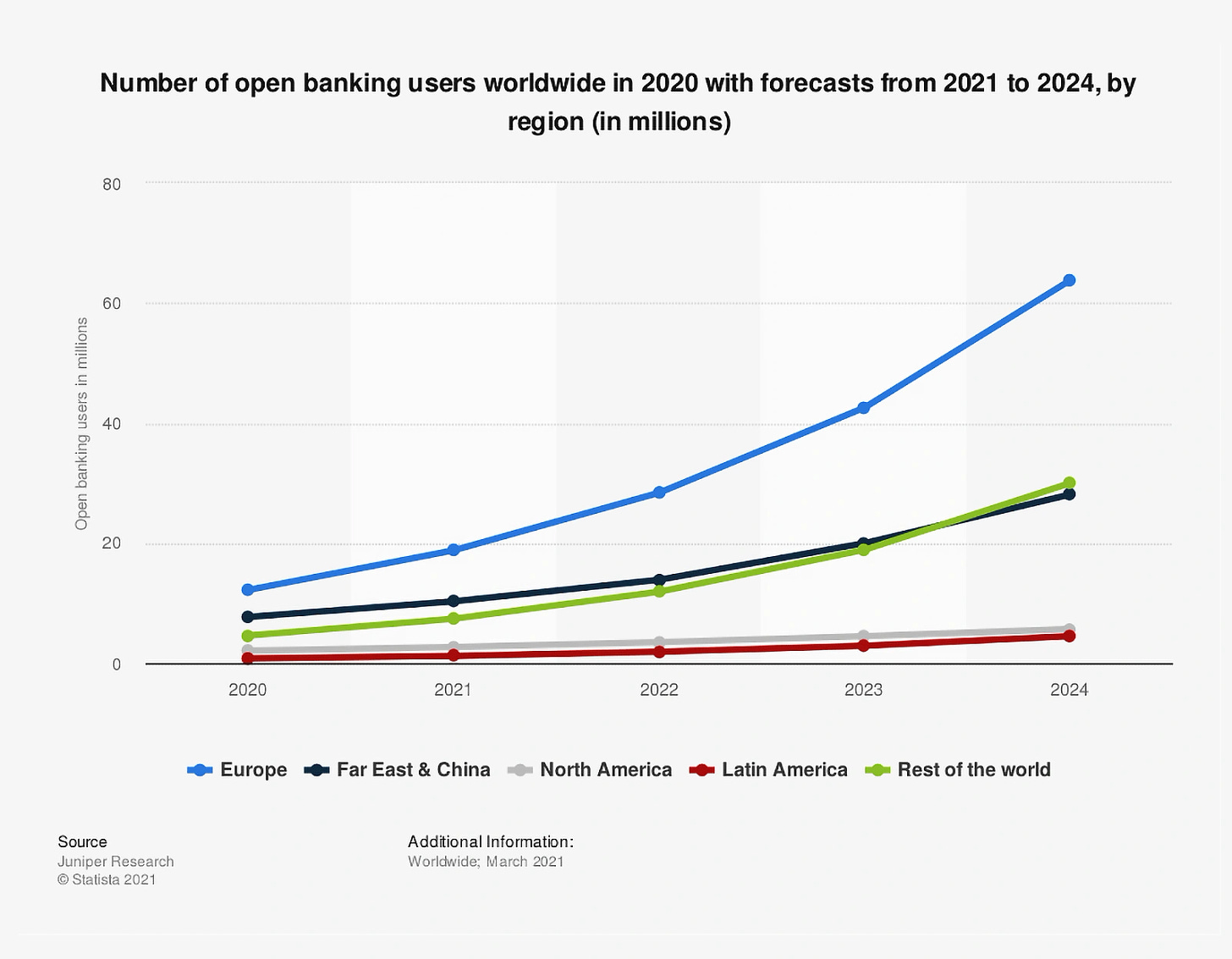

3. Increased adoption of Open Banking

As more financial institutions open up their data and functionality through APIs, we will see a proliferation of FinTech firms building innovative products and services on top of the open banking (OB) infrastructure. Europe will continue leading the world in OB.

Given the global value of payments facilitated by open banking is expected to grow by 2,800% between 2021 and 2026, if you’re a FinTech company that doesn’t have an open banking strategy, I’d be seriously worried.

Bonus:

Open Banking is the Next BIG Thing in FinTech since Plastic 💳

JPMorgan + Mastercard, or why the future of Banking is Open 👐🏼

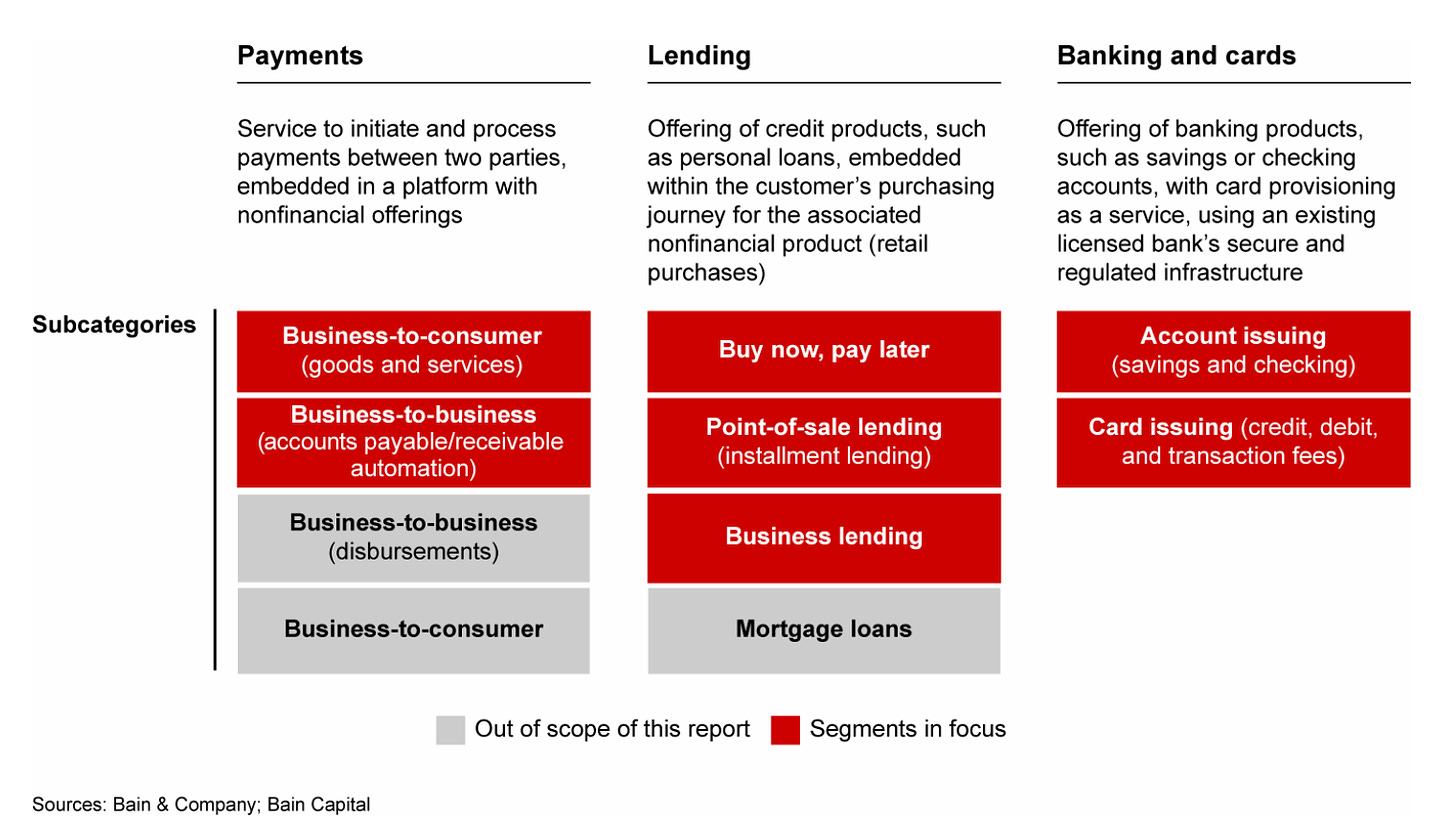

4. Embedded Finance will explode

FinTech is eating the world and every company is becoming a FinTech company now. Expect to see more of this in 2023, with embedded finance at the core of it all. We’re already seeing this happening in consumer and business lending (a case in point here is PayPal PYPL 0.00%↑ which is the largest non-bank lender or Shopify SHOP 0.00%↑ which derives 73% of its revenue from FinTech services) as well as in the Buy Now, Pay Later (BNPL) space (remember - it’s a feature NOT a product).

All of this will be mostly driven by consumers that are less interested in traditional stand-alone financial services and are in favor of embedded experiences. The future of finance is embedded, so if you don’t have a strategy for that, I would be seriously worried.

Bonus:

Amazon shows why the future of FinTech is Embedded 🗂 (+4 extra reads)

Railsr’s Series C and why the future of finance is embedded 💸

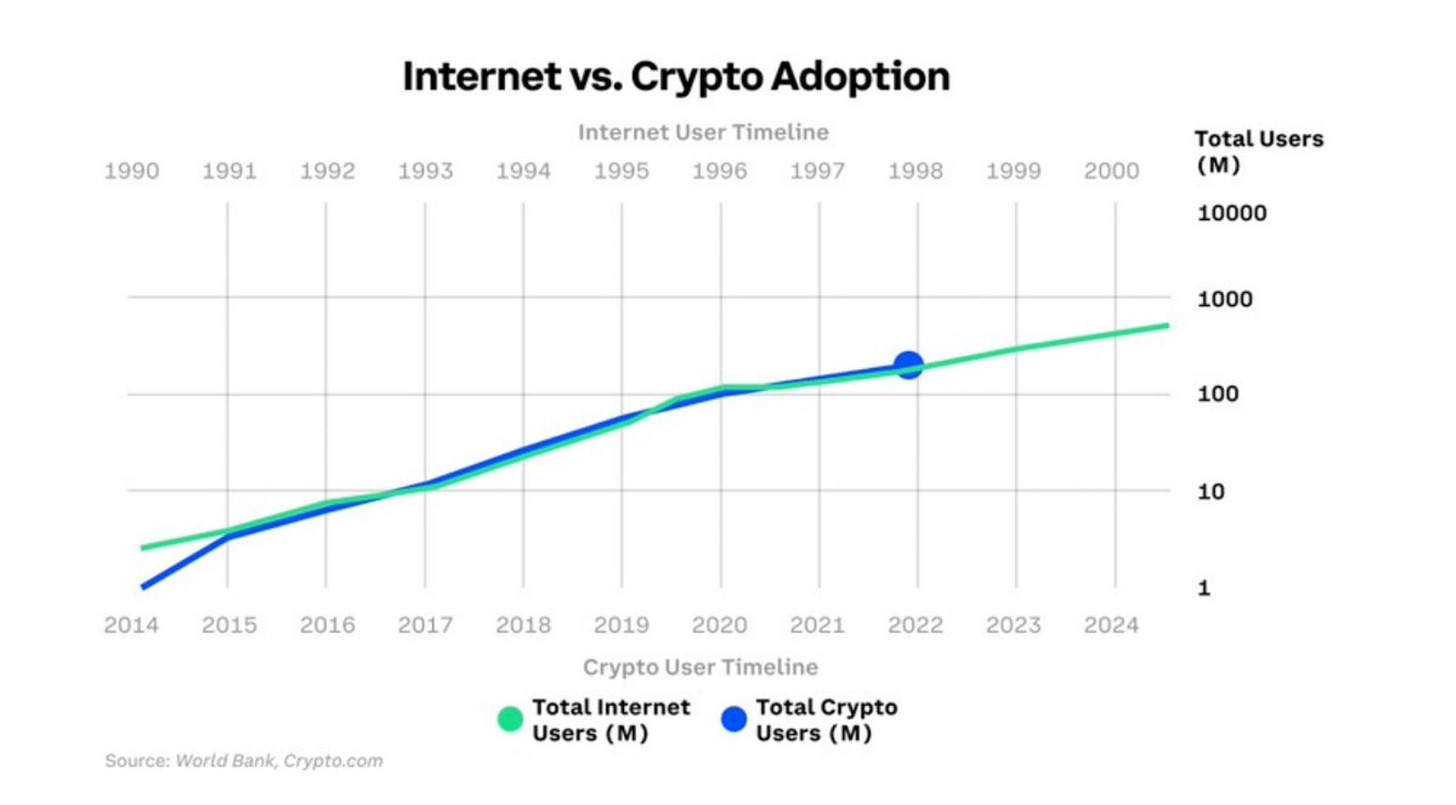

5. Banks will continue moving into crypto while crypto firms will keep transitioning into banking

From crypto to banking and from banking to crypto. The transformational trend we started to see more clearly just a couple of years ago in Finance will only accelerate in 2023. The lines between traditional finance and alternative finance (think crypto, DeFi, etc.) will hence become even more blurred.

The good thing? We’re still very early.

Bonus:

Banks are becoming crypto companies while crypto companies are becoming banks ₿🏦

Binance wants to be your Crypto Bank 🏦

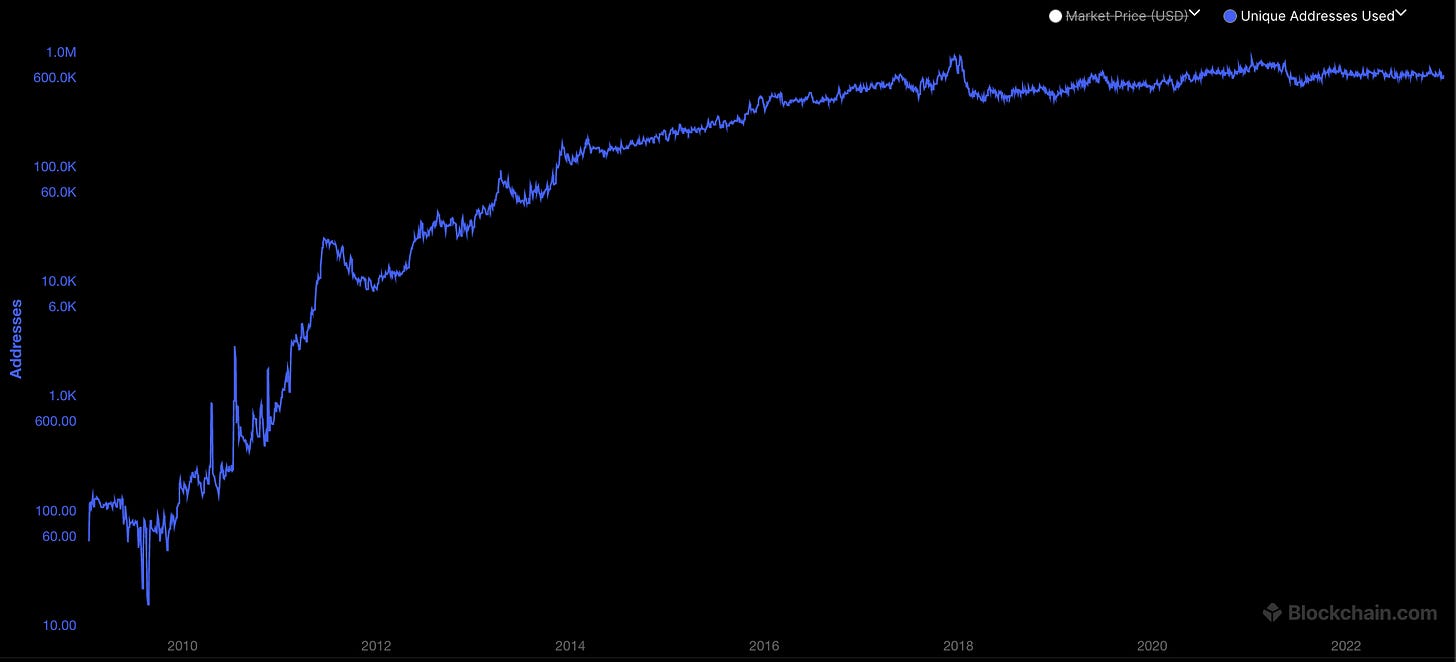

6. Blockchain will continue revolutionizing finance

As the hype and speculation have faded away, the continued development of the infrastructure will help the financial industry see wider adoption of blockchain technology (especially in decentralized finance aka DeFi space).

Graph: The total number of unique addresses used on the blockchain. Source: Blockchain.com.

The verticals that should gain more traction are trade finance, remittances, and lending. Someone that does this well - JPMorgan JPM 0.00%↑.

Bonus:

JPMorgan, DeFi, and the future of finance 💸

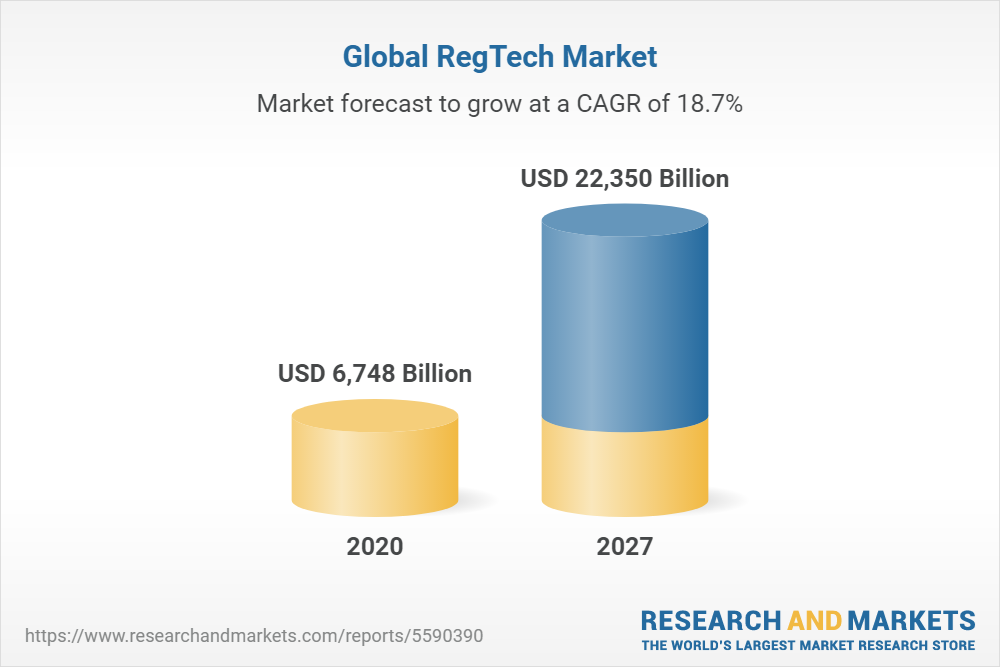

7. RegTech will boom

As the FinTech sector continues to grow and mature, we will see increased regulatory scrutiny and the implementation of new rules designed to protect consumers and ensure fair competition. This became especially relevant after the recent AML and compliance scandals in both FinTech and banking industries, not to mention the massive hacks in DeFi and crypto. Leveraging cloud technology, machine learning, and big data analytics RegTech will be at the core of helping companies to identify and prevent risks, as well as to stay in compliance with regulations.

Bonus:

RegTech will be the hottest thing in Web3 in 2023 🚀

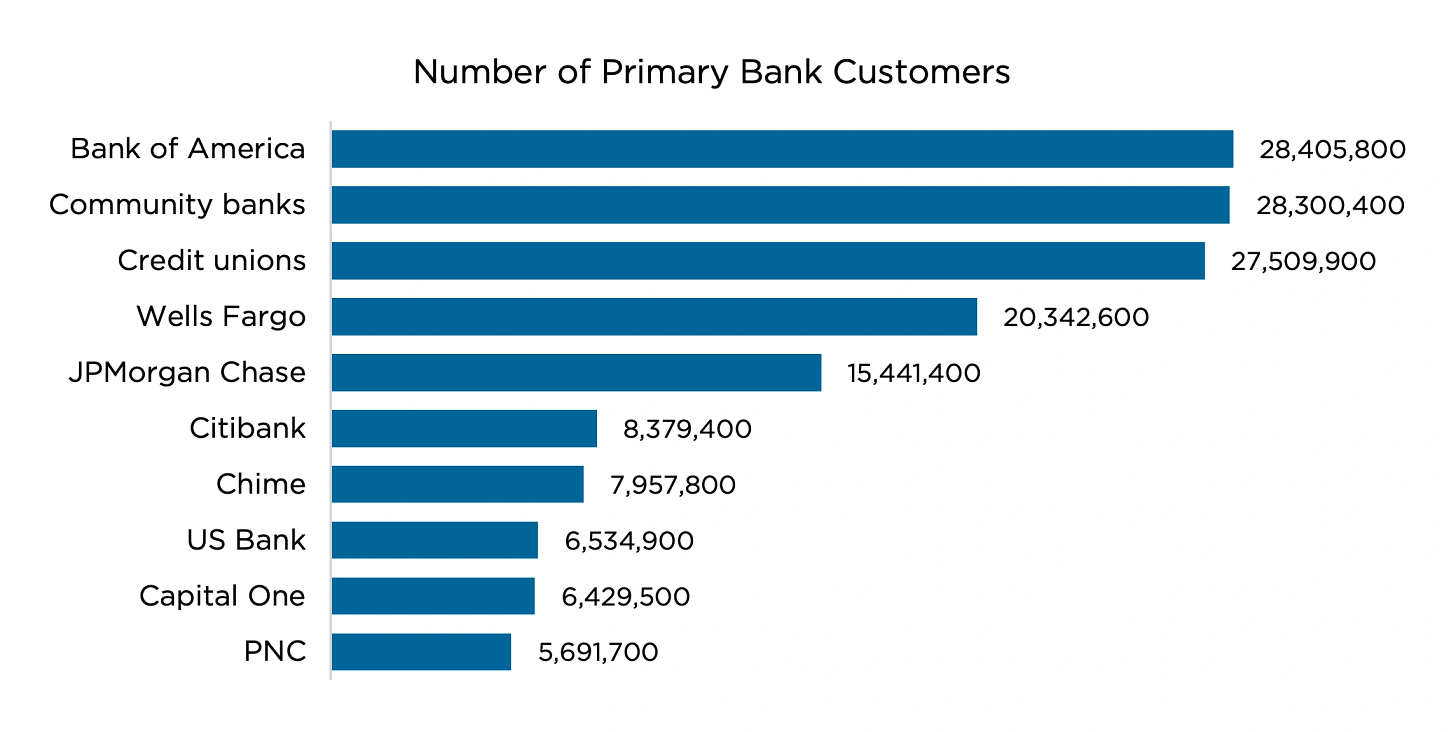

8. Neobanks will continue to change the banking landscape

Neobanks and digital-only banks will continue to grow in popularity as consumers (especially young ones) become more comfortable with managing their finances digitally. Given only 25% of Gen Z use a big bank as their primary checking provider, it’s not surprising that the neobank market is expected to be worth about $722 billion by 2028 (an annual growth rate of almost 50%).

Chime is right behind established mega-banks like Citibank and JPMorgan Chase in terms of primary accounts. Source: Exploding topics.

Expect even more growth in emerging markets, especially Latin America.

Bonus:

The future is purple. Nubank Purple 💜

9. Big Tech will move deeper into banking

Gaining more and more steady users and enhancing their ecosystems, the tech giants of the world are beginning to see more value in providing financial services to their customers. It all began with payments but nobody is going to stop here.

Hence, companies like Apple AAPL 0.00%↑ have continuously been adding more digital banking services, with a single goal in mind - that the need and demand for traditional banking services would wane. And you would ultimately bank with Apple, NOT a bank. For 2023, watch out for Apple and Walmart WMT 0.00%↑ as they change FinTech forever.

Bonus:

Welcome to Apple Bank - your everyday Banking from Apple, NOT a Bank 🍎🏦

Walmart is building a Super App than can change FinTech forever 📲

10. BNPL will keep growing strongly

The Buy Now, Pay Later (BNPL) market surged to a value of $120 billion in 2021, which represents a CAGR of 85% between 2019 to 2021. That’s massive! Despite regulatory concerns and the collapse of valuations of both Klarna and Affirm AFRM 0.00%↑, the BNPL pioneers, the industry still stood strong. This should continue not only in 2023 but all throughout 2028 with research predicting BNPL growing at a CAGR of 32.5% (as per Research and Markets). As noted a couple of times earlier, you can’t build a sustainable business on it alone, but if you don’t have a BNPL strategy as part of your roadmap you are definitely going to miss out.

Bonus:

If you don't have a BNPL strategy, you're missing out 🫵

Affirm offers a profitability strategy that other BNPL FinTechs should steal 👏

The real winner of the BNPL Wars is…Mastercard? 🤔

And that’s a wrap. 2023 will be another great year for FinTech. Let’s keep building 🚀

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

(edited)

Re: Big Tech Moving into banking. Payments have long been an easy to implement at scale cash cow. Credit cards are much harder, that's why most networks are on Visa or Master Card, and tech companies are powered by existing banks. Example Apple's backend is Goldman Sachs.

Banking is a cash cow, but it's hard to break into. Starbucks uses gift cards to be a bank functionally, but the goal is just a huge interest free loan. Credit unions compete with banks on some level by sacrificing profit to benefit customers.

Apple is seemingly offering absurd interest rates (relative to everyone else in main street banking). But Apple isn't a company to forgo profit. So is this just subsidized by credit cards or what?

Hi Linas, can you respond to my message on Linkedin :) Thank you. Audruius